The Facts About Trace Zero Uncovered

The Best Guide To Trace Zero

Table of ContentsThe Ultimate Guide To Trace ZeroThings about Trace ZeroAll About Trace ZeroTrace Zero Things To Know Before You BuyTrace Zero Things To Know Before You Buy

Carbon accounting enables businesses to prosper in the net-zero change and handle climate-related dangers. Organizations with durable carbon bookkeeping practices are better placed to satisfy need from consumers, financiers and regulators (like the EU CBAM and UK CBAM), and can recognize threats and affordable chances. Nevertheless, there are restrictions to carbon accountancy if it's refrained effectively.Organizations need to use their carbon accounting information and insights to take the ideal steps., and less than fifty percent are determining their supply chain emissions.

Recurring mix factors resemble grid-average aspects but are calculated based on electrical power created from non-renewable resources, as an example, oil, gas, coal or various other sources not backed by EACs. If recurring mix aspects are not available for an area, after that conventional grid-average factors should be made use of, because they remain in the common location-based method.

The Trace Zero PDFs

Factor 5 calls for that certificates be sourced from the very same market in which the reporting entity's electricity-consuming procedures lie and to which the tool is used. This indicates that it would certainly be wrong to allocate certificates released in the United States to consumption in the UK (trace carbon solutions). If the organization has power acquisition arrangements, the certificates might not exist

Baseline-and-credit systems, where baseline discharges levels are specified for private regulated entities and credits are released to entities that have lowered their exhausts below this degree. These credit reports can be marketed to other entities surpassing their baseline discharge degrees. straight sets a cost on carbon by defining a specific tax rate on GHG exhausts ormore commonlyon the carbon web content of fossil fuels, i.e.

The Definitive Guide for Trace Zero

It is different from an ETS in that the emission reduction outcome of a carbon tax obligation is not pre-defined yet the carbon rate is - https://trace-zero.webflow.io/. assigns the GHG emission decreases from project- or program-based tasks, which can be sold either locally or in other countries. Crediting Mechanisms issue carbon debts according to an accountancy protocol and have their own pc registry.

For governments, the choice of carbon pricing type is based on national situations and political truths - carbon footprint tracking. In the context of obligatory carbon rates efforts, ETSs and carbon taxes are the most common kinds. One of the most suitable campaign kind depends on the particular situations and context of a given territory, and the instrument's plan goals need to be lined up with the more comprehensive nationwide economic top priorities and institutional abilities

Indirect carbon rates initiatives are not currently covered in the State and Patterns of Carbon Prices collection and on this site.

The Ultimate Guide To Trace Zero

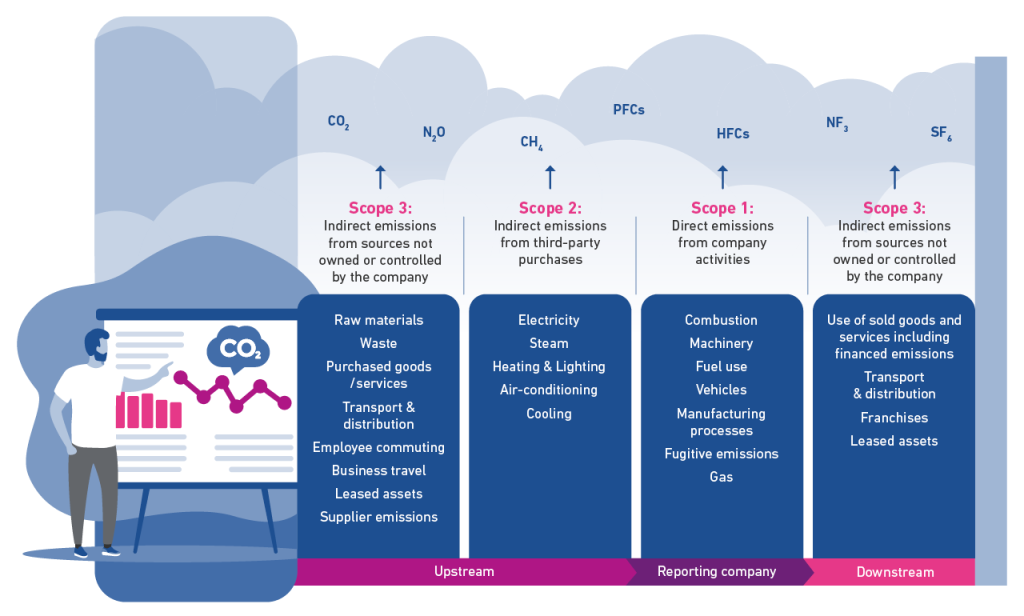

Carbon accountancy procedures emissions of all greenhouse gases and includes carbon dioxide, methane, laughing gas, and fluorinated gases. Gases besides carbon are revealed in regards to carbon equivalents. Governments, businesses, and individuals can all utilize carbon bookkeeping to determine their greenhouse gas exhausts. The overall greenhouse gas discharges produced by a person, country, or business is referred to as their.

For instance, in 2012, the UK union federal government presented mandatory carbon reporting, requiring around 1,100 of the UK's largest listed companies to report their greenhouse gas discharges annually. Carbon accountancy has given that risen in significance as even more policies make disclosures of exhausts obligatory. Therefore, there is a higher pattern in coverage requirements and guidelines that require firms comprehend where and exactly how much carbon they release

ESG structures measure a business's non-financial efficiency in environmental, social and administration classifications. Carbon audit is a crucial component of the E, 'Environment', in ESG. is a metric procedure utilized to contrast the exhausts from various greenhouse gases based on their Global warming capacity (GWP). GWP determines the loved one potency of various greenhouse gases in capturing heat inside the earth's ambience.

Our Trace Zero Ideas

A carbon matching is determined by converting the GWP of other gases to the equivalent amount of carbon dioxide - carbon accounting. As pressure rises to lower discharges and reach ambitious decarbonisation objectives, the role of carbon accountancy is significantly critical to a service's success. Along with climate pledges and governing restraints, the rate of carbon is steadily increasing and this additional incentivises the private industry to determine, track and decrease carbon emissions

Carbon bookkeeping allows firms to pinpoint where they are launching the most exhausts (https://www.brownbook.net/business/54558067/trace-zero). This allows them to prioritise decarbonisation approaches on where they will certainly have the best influence. carbon accounting identifies one of the most effective bars for decarbonisation. Carbon accountancy is the very first and essential step to emissions reduction, which is vital if we wish to continue to be listed below 2 degrees of global warming.